LOS ANGELES, CALIFORNIA: Once hailed as the inspiration behind Aaron Spelling’s ‘Dynasty’, the billionaire Davis family has been plagued by infighting and tragedy since the death of their patriarch and oil tycoon Marvin Davis.

The affluent family recently suffered another legal blow after it came to light that Marvin's 40y-year-old grandson Alex Davis is going to trial against his own step-father, Kenneth D Rickel.

Alex, who amassed enormous wealth from his early investments in the genetics company ‘23 & Me’ and the data company ‘Palantir’, now oversees an investment firm featuring notable sportsmen Patrick Mahomes, Justin Verlander, Naomi Osaka, and Robert Lewandowski on its board.

However, Rickel alleged that Davis defrauded him of more than $50 million in their joint venture and then broke a deal they made to patch things up.

What allegations did Kenneth D Rickel make against Alex Davis?

Rickel's legal lawsuit, which was submitted in December 2020, is a scathing indictment of Davis, accusing his stepson of ''untreated drug and wine addiction'' and a ''mean spirit," calling him a ''pathological liar, unstable, and erratic," an ''ingrate," ''a malignantly-flawed character'' and ''unable to curb his greed."

He alleged that Davis his share of their company, Disruptive Technology Advisors (DTA), in 2014 when he ''was attending to his dying father in Florida."

The amount of money they are battling is over-expanded due to the success of projects like Palantir, in which they invested $8.5 million in its early stages and raised an additional $275 million, according to Daily Mail.

Rickel also claimed that Davis ''created fraudulent documents literally removing him from his own business and transferring Rickel's 50 percent ownership share to two of Davis's friends.''

In legal documents, Rickel called Davis a ''a pathological liar'’ and also branded him as a drug addict.

''He abuses prescription drugs, opioids, and sleeping pills. His recollection is clouded by his addiction problem, and he is not clear-headed, nor a clear thinker,'' his 2020 legal filing said.

The 70-year-old continued by stating that when Davis' biological father abandoned his mother, Nancy Davis, he reared Davis and repeatedly bailed the boy out of tight situations.

''Believing that they had a genuine father-son relationship, Rickel trusted Davis,'' Rickel said in legal documents.

Rickel filed the furious suit in response to Davis' initial complaint, which was filed in September 2020, and requested a judge to enforce their 2014 agreement, which Davis claimed his step-father was violating.

In the complaint, Davis emphasized on Rickel's previous illicit securities trading, for which the SEC accused him in 2008 and fined him for $150,000.

Now nearly three years later, Davis and Rickel are set to face off in a courtroom battle before a jury beginning in Santa Monica Superior Court on Thursday, October 05.

Rickel's wife and Davis' mother Nancy, 65, is likely to be embroiled in the courtroom drama, with Rickel's lawyers calling her as a witness – to Davis' dismay.

The rise of the billionaire Davis clan

Before suffering major family feuds, the powerful Davis clan was considered one of the most influential families in the Hollywood industry, thanks to the legacy carved by Marvin Davis.

Davis, who was widely known as “Mr Wildcatter” was the elder son of Jean Spitzer and Jack Davis, who left London for New York in 1917.

After founding Jay Day Dress Co, Jack went on to partner with Ray Ryan in 1939 when they laid the foundation of Davis Oil Company.

Soon, Marvis earned his bachelor’s degree from New York University and joined his father in the oil exploration business. In the 1960s-1980s, the company became a leading independent oil and gas producer in the United States, focusing on drilling in Wyoming, where the company owned a 150-mile pipeline.

However, in 1981, Davis sold most of his oil holdings for $600 million and went on to acquire 20th Century Fox for $722 million with financier Marc Rich.

At that time, Fox's assets included Pebble Beach Golf Links, the Aspen Skiing Company, and a Century City property upon which he built and twice sold Fox Plaza.

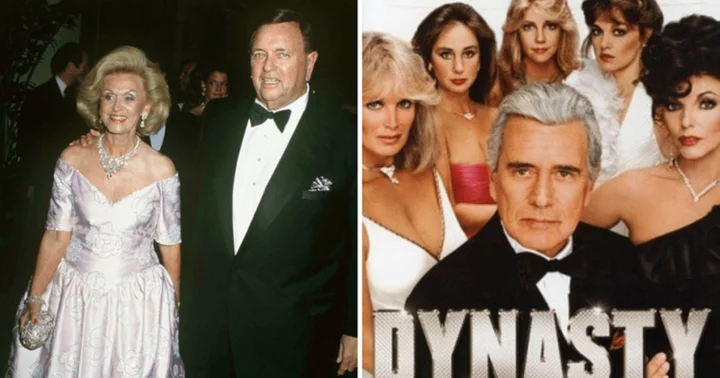

By the late 1980s, Davis became so rich that his friend Aaron Spelling loosely based the Carrington characters of his hit night-time soap “Dynasty” on the Davis family.

“He was always fun,” novelist Jackie Collins told Vanity Fair in 2005.

“He was Marvin! He would try to intimidate people. His first question would be: How old are you and how much money do you have? I think he liked me because when I met him and he asked me that I said, ‘F**k off, Marvin!’ ”

As Marvin continued to expand his fortune, he lost his interest in Fox and sold his holdings to Rupert Murdoch for $250 million in March 1984.

During his professional hustle, he also married the ‘love of his life’ Barbara Levine.

They stayed together for 53 years and welcomed five children, Dana Davis, Gregg Davis, Patricia Ann Davis Raynes, John Davis, and Nancy Davis Rickel.

The family feud that led to the fall of the Davis family

A series of illnesses plagued Davis in his final ten years, including diabetes, heart disease, a spinal tumor, pneumonia, and sepsis.

Eventually, the oil tycoon died at The Knoll on September 25, 2004, at the age of 79. Marvin’s death became the tragedy that led to the fall of his billionaire family.

The Davis family fortune was once said to be as much as $5.8 billion but that mysteriously disappeared by the time Marvin died, as per NY Post.

Notably, just a year after Marvin’s death, Raynes sued her four siblings, her mother, and several family advisers, claiming they had helped her father loot her trust fund.

“This is a case about greed, theft, and betrayal, a case about how Marvin Davis, who was one of the wealthiest men in America, systematically stole hundreds of millions of dollars from the trust created for his oldest daughter, Patricia Davis Raynes, to finance his own business interests, the business interests of his two favored sons, and a lavish lifestyle for himself, his wife Barbara Davis, and his other children,” Raynes’ 169-page lawsuit claimed.

The lawsuit also claimed that Marvin tried to intimidate his own children. “Instead of distributing the trust property to Patricia when she turned twenty-one, Marvin forged Patricia’s signature on new trust documents,” the lawsuit read.

To keep control of Patricia’s trust property, Marvin coerced Patricia by threats and acts of violence, to sign still other documents that perpetuated his control of her property

Eventually, Raynes settled with all 14 parties, and the case was closed in 2008. However, Raynes was not the only Davis family member, who had a money issue.

Nancy claimed that her brother Gregg Davis defrauded her and her mother Barbara Davis out of millions by lowballing the value of Davis Petroleum in a forced bankruptcy sale.

Nancy attempted to sue Gregg for $50 million, alleging that they had planned to conspire to acquire the company for $150 million when it was actually worth $1 billion. They refuted it, and a court ruled that Nancy couldn't file a lawsuit.

Nancy herself filed for bankruptcy in 2011. Three years later, her sons — Brandon, Jason, and Alexander — were sued over allegedly “fraudulent” money transfers made to them by Nancy.

Now, Nancy’s sons are now also falling into these legal fields.